Conozca a su partner global

en soluciones bobina a bobina

innovadoras y sostenibles

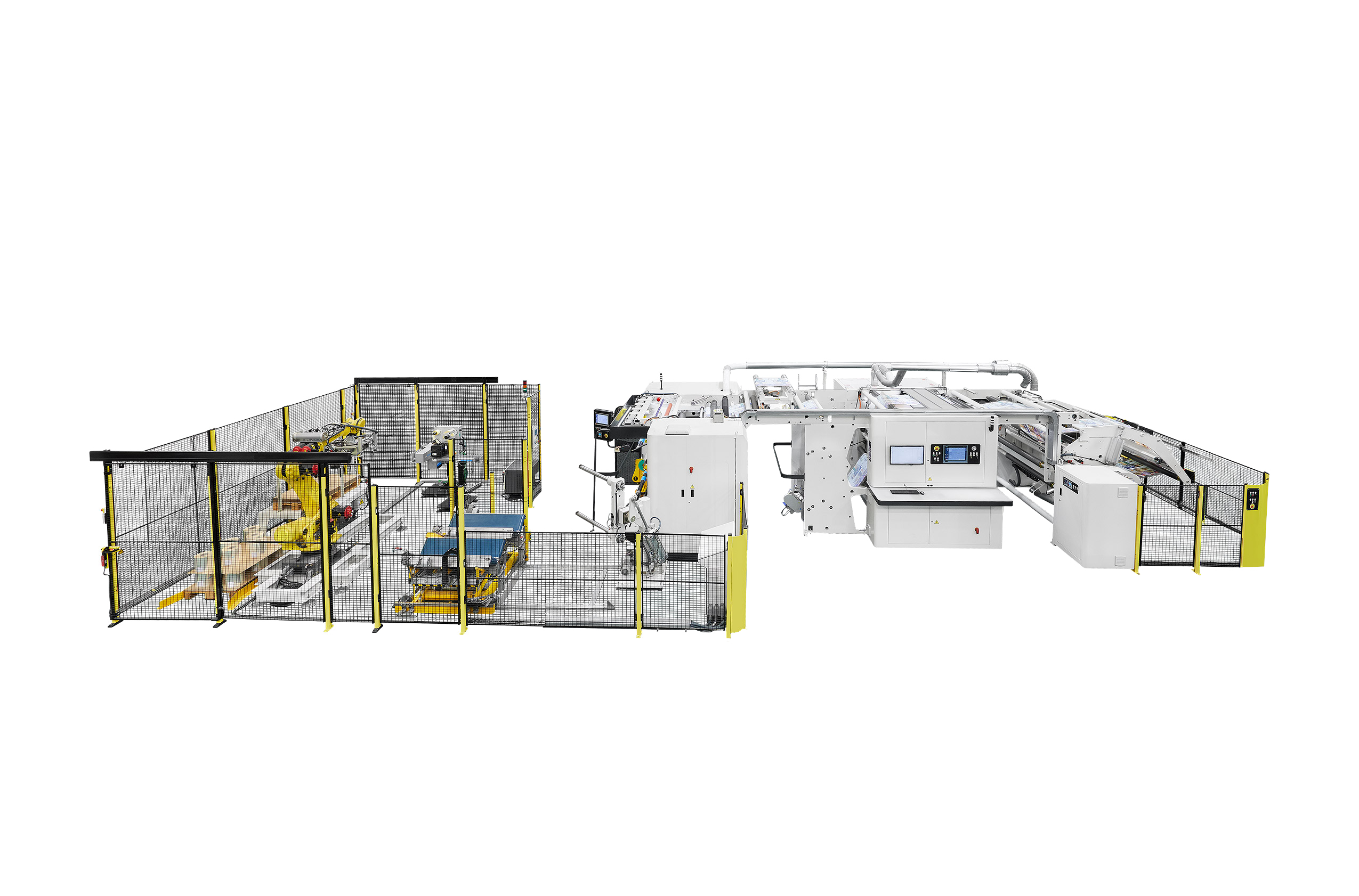

Ofrecemos soluciones globales en impresión, laminación y corte

Somos un socio global para envases flexibles. Desde la impresión hasta los procesos de automatización de final de línea, Comexi le ofrece una amplia gama de soluciones innovadoras Nuestro servicio 360° está a su lado desde el principio y durante todo el ciclo de vida de su máquina.

Manténgase al día de las últimas noticias y descubra los eventos más relevantes en nuestra sección Últimas noticias.

Comexi lidera el innovador proyecto MADAM para mejorar la producción de envases

Comexi lidera el innovador proyecto MADAM para mejorar la producción de envases...

Liderazgo en innovación y sostenibilidad: Reflexiones del Presidente de Comexi, Manel Xifra y del Fundador de Hotpack Global, Abdul Jebbar

Liderazgo en innovación y sostenibilidad: Reflexiones del Presidente de Comexi, Manel Xifra...

Comexi presenta un Centro Tecnológico de Vanguardia en Miami, Marcando un Hito en la Industria del Packaging Flexible.

Comexi presenta un Centro Tecnológico de Vanguardia en Miami, Marcando un Hito...